Any Questions, Call / Text: 954.881.1611

With The Protection Plan

We have helped 195,145 people

Fix Their Credit & reach their financial dreams

- Without waiting years

- Get a FREE credit analysis

- Good credit allows you to buy your house, auto, or refinance your bank loan

- Without waiting years

- Get a FREE credit analysis

- Good credit allows you to buy your house, auto, or refinance your loan

How can we help?

#1 RECEIVE A FREE CREDIT ANALISIS

In the analysis of your credit we will identify the negative elements that exist and at the same time create your plan to strengthen your credit.

#2 REMOVE NEGATIVE ITEMS FROM YOUR CREDIT

Using our credit tool we can help you eliminate negative elements such as:

- Auto Repros

- Collections

- Foreclosures

- Late Payments

- Medical Bills

- Student Loans

- Evictions

- Child Support

- Bankruptcies

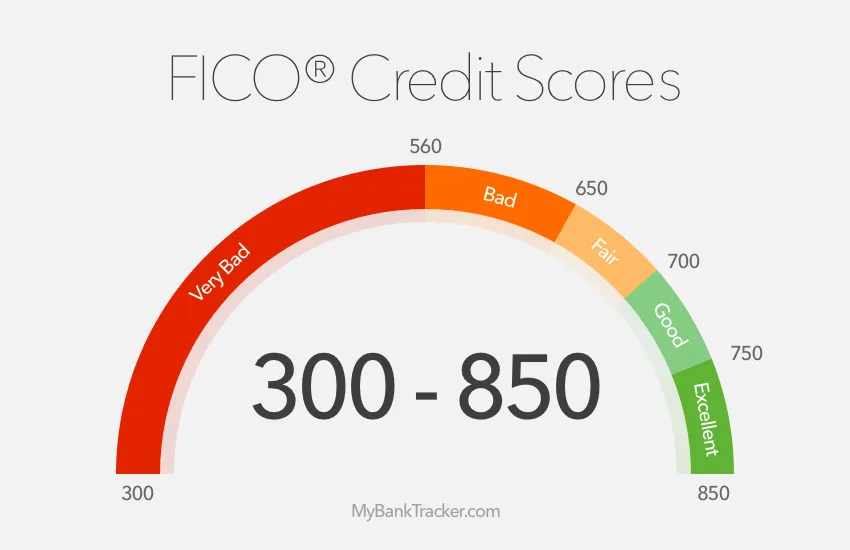

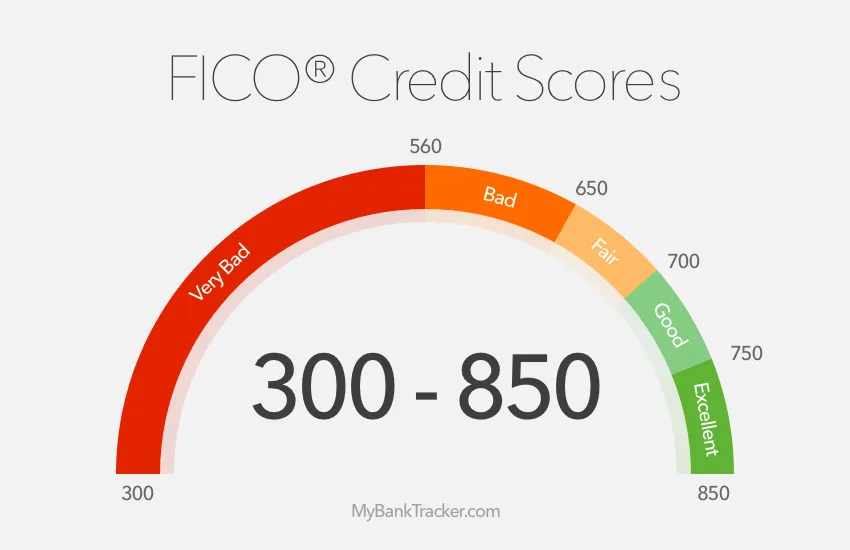

#3 THE BENEFITS OF GOOD CREDIT.

Having good credit is having access to money. Good credit is necessary to: rent an apartment, buy a house or car, to obtain a loan, to obtain a cellular service and to facilitate a student loan for your children.

Start a consultation to check your credit

Proven Results...

SATISFIED CUSTOMERS

We have helped

195,145 people

achieve their

financial dreams

Stop by our

"Protection plan"

To start seeing results with your credit in 45 to 90 days!

We aggressively challenge incorrect and unverified information on your behalf to restore your credit score.

Start saving money

and get the benefits of having great credit!

With your great credit score, you'll have the experience of being offered lower interest rates, lower insurance premiums, and better credit rates and new loans, saving you thousands of dollars every year!

Who I am?

Juan Nuñez

Regional Vice President

Experto en crédito

I have been in business since I was 21 years old. Born and raised in New York City where I stayed there for the first 44 years of my life. Now from Florida we enter the world of helping people improve their credit and thus we have impacted the lives of many people. I invite you to improve your credit so that you can reconnect with your dreams of being able to acquire your home and achieve the American dream.

Juan Nunez

Regional Vice President

Credit Expert

Current Client Testimonials...

"Juan Nuñez is the CONNECTION"

In March of this year (2021), my credit was at 524 in search of improving my credit so as not to have to wait 7 years to fix it, I was recommended to Mr. Juan Nuñez. Today thanks to that decision that I made in 5 months my credit is at 706. I was born again, thanks Juan for your help.

Concepcion Garcia, Netcong, NJ

" I can already buy my house..!!

I am very grateful for the results obtained with Juan Nuñez. I had the credit at 544 and it shot up to 764 in 6 months. Juan Nuñez eliminated the replacement of a car from my credit report. Having good credit in the United States is having access to money. Today I get many pre-approved cards, that never happened when my credit was bad.

Erika Morillo, Brooklyn, NY

FREQUENT QUESTIONS

Credit Restoration is encouraged by the law and therefore weighs on your side. Studies have shown that many Americans have errors on their credit reports and we're experts in getting them resolved.

1.) Is Credit Restoration Legal?

Yes, in fact, not only is it legal but the law called “The Fair Credit Reporting Act” weighs the balance in your favor. The FCRA gives you the right to dispute any item on your credit report. If within a reasonable timeframe (usually 30 days) this item cannot be verified it must be removed. Per a Federal Trade Commission (FTC) study, 79% of all credit reports have an error that makes them deemed less creditworthy than they actually are. This is nearly 8 out of 10 reports. Therefore most credit reports improve immediately. For items disputed that are not errors, a creditor or furnisher is often unable to find the records or signed documents within the allotted time and the item gets removed. Sometimes the furnisher will say it has been verified but not offer proof. It is our job to prepare documents that challenge this which is our expertise.

2.) Is Credit Restoration worth my time and money?

If poor credit is keeping you from qualifying for a credit product, such as a mortgage or a car loan, or is causing you to pay high-interest rates, the time and money invested into Credit Restoration is a well worth investment. High-interest rates can cost you thousands of dollars a year – and is sometimes the cause of additional late payments which will worsen your credit score. If it’s a mortgage or a car loan you’re after, poor credit will prevent you from qualifying, which not only affects you financially but also affects your lifestyle. Anyone with a credit score below 720 can benefit long-term from advice, information, and education around credit restoration. However, there are limiting factors that will prevent us from helping you. Two main factors are: (1) your financial situation and/or (2) the time frame in which you need to reach your results. It is possible to remove anything from a credit report, even accurate items. For instance, if the creditor makes mistakes or does not adhere to the specific time frame, the negative item may be removed. Also, there are specific requirements the Credit Bureau, Collection agencies, and Creditor must adhere to, when placing items on consumer credit reports, if these requirements are not met, the negative items can be removed.

3.) What can I expect when I enroll?

This is a held-by-the-hand hands-on process from start to finish and prepares all of your documents for you. Our years of experience have allowed us to accurately communicate with creditors and credit bureaus in order to successfully improve credit scores. While you can do this on your own, there may be difficulties with creditors and bureaus without an adept understanding of their techniques and regulations in place for credit reporting. We have spent the last 17 years learning the laws that will help you to remove negative information on your report, which enables us to offer you a PROVEN system.

(Clients should receive updated credit reports every 15-45 days. It is the client's responsibility to check or refresh for updates in our Smart Credit app or website).

4.) How long will it take to raise my score?

You can see a boost in credit scores within 24-48 hours thanks to credit boosts methods. Credit Bureaus have 30 days to respond to challenge letters, so you will see improvement within the first 45 - 60 days. NOTE: Each credit report is different, thus credit completion will vary based on your current credit standing and your credit goals. Many clients average 3-5 months in the program.

5.) Why is the Protection Plan Membership different?

Our methods are different from the traditional credit repair process, giving us an advantage in winnable challenges and timeframes. All while building your credit with positive new items.

On average, we have successfully dispute-to-delete over 2,000,000 negative items from a credit report. Our fees are fair, trustworthy and we GET RESULTS!

6.) Will the removed items come back?

In most cases (98%) removed items do not come back. By law, collection agencies and credit bureaus must notify you before putting items back on your report. Moreover, collection agencies can transfer debts, in which case, you have 30 days to respond to the debt. If an item does come back, we can immediately take action and target to delete it.

7.) What items can you help me to remove and improve?

With our assistance, our clients have had great success with bankruptcies, child support, late payments, collections, charge-offs, repossessions, medical bills, utilities, credit card debt, inquiries, old addresses, judgments, tax liens, foreclosures and student loans.

What are you waiting for?

Take Control of Your Finances!

Copyright © 2021 All rights reserved - jnunezfinancial.com, your experience

Terms and Conditions

Privacy policies